Our Company Strategy

At Sprich Capital, we utilize a dynamic, diversified strategy that is always in motion. We pull together funds from a variety of income avenues to redeploy them as a powerful workforce of dollars. Each dollar becomes a "worker," sent off on carefully chosen assignments: short-term, long-term, low-risk, high-reward. These little money-workers operate across different roles and divisions, all driving toward one goal: building a sustainable profit ecosystem.

Think of money as being distributed into "pods", with each representing an independent strategy or project. For our company, one of our most proven pods is Real Estate. When we find the right property, we deploy just the necessary resources needed, only when needed, while the rest of our combined funds keeps working in other areas. As projects progress, we reallocate the money-workers as needed, always aiming to keep all funds active and multiplying. When a project wraps up, any gains are quickly reintegrated into the current most productive areas of our profit ecosystem at that time. By setting up projects in a staggered delivery schedule, this keeps all funds constantly moving between the most productive pods and never growing stale.

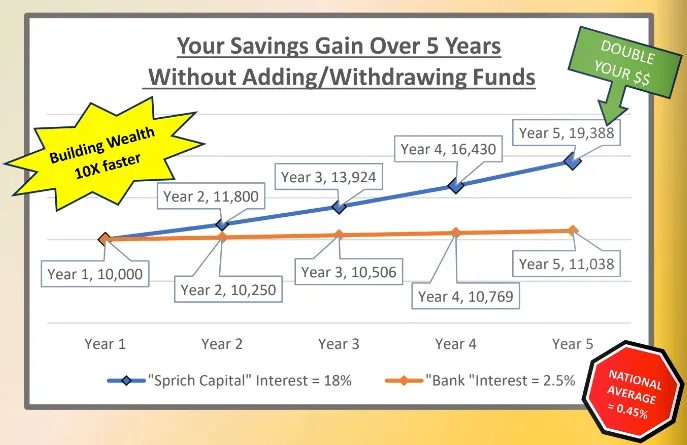

With this smart and adaptive system along with two decades of experience, Sprich Capital has been able to average consistent high-yield gains which let us deliver on high-interest borrowing that benefits our lenders. While our funds are in motion and more funding is acquired through various lending options, with market changes and fluctuations, and various projects coming on and off-line; all earned funds are efficiently managed to cover expenses and interest payments on our funding, then funneled back to the profit ecosystem. You can see how this type of a system can produce growth in action with our Earnings Calculator.

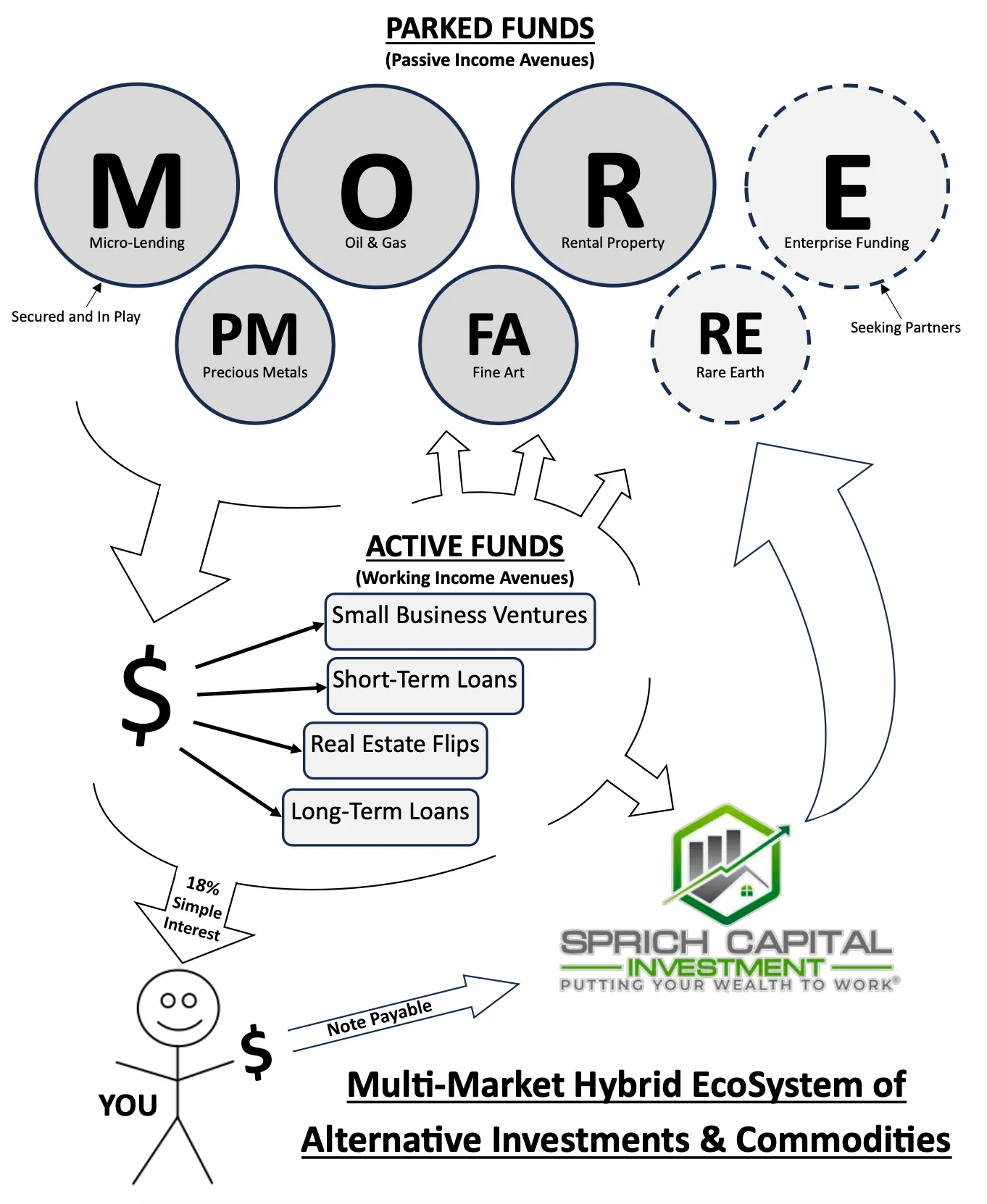

Below is a general breakdown of how we allocate and manage our multi-market hybrid ecosystem.

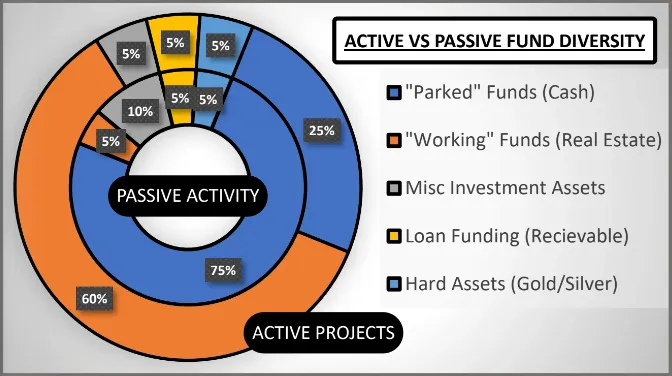

While awaiting higher return opportunities, the majority of our funds are "parked" in high-yield activities, along with other passive income avenues. When not "parked", Sprich Capital utilizes these "active" funds, only withdrawn as needed, for supporting projects in local Real Estate, using a proprietary formula to produce high profitability, and a growing local business operations portfolio. Once a project or profit timeline is completed, the net funds are "parked" and continue to earn passive gains until another "active" opportunity is available.

By pairing these income avenues together, whether the funds are actively working or passively parked, they are always earning, with a consistent flow of gains coming from no less than 30% of the total funding pool.

A portion of our funds is sometimes used to provide capital loans for individuals or local businesses. These loans are heavily collateralized, and made under prime+ terms to offset any risks. Our remaining funds are split across various income avenues, including hard assets such as tangible property, market equities, precious metals, as well as leverageable equity. These are held both short and long term, with favorable rates, to help provide additional stable and consistent low-flow income.

This diverse profit ecosystem, combined and gain-averaged, allows Sprich Capital to continue servicing our lenders indefinitely. This overall strategy is based on a mixture of how many separate industries and financial entities operate, we are just cutting out the middleman and combining the most effective parts to produce a better whole-package approach. Sprich Capital maintains low overhead, utilizing our productivity to put funds effectively and efficiently.